Halifax Build vs Buy Cost Calculator

How much will building a home cost you in Halifax?

This calculator shows the real costs of building versus buying a 2,000-square-foot home in Halifax in 2025.

Remember: Building often costs more than buying an existing home due to hidden costs and time expenses. According to the article, building typically costs $750,000-$1.2M versus $400,000-$550,000 for similar existing homes.

Results

Total Building Cost

Total Buying Cost

Biggest Hidden Cost to Remember

You'll pay for rent while your house is being built. At $2,800/month for 14 months, that's $39,200 - a cost that's often overlooked in initial estimates.

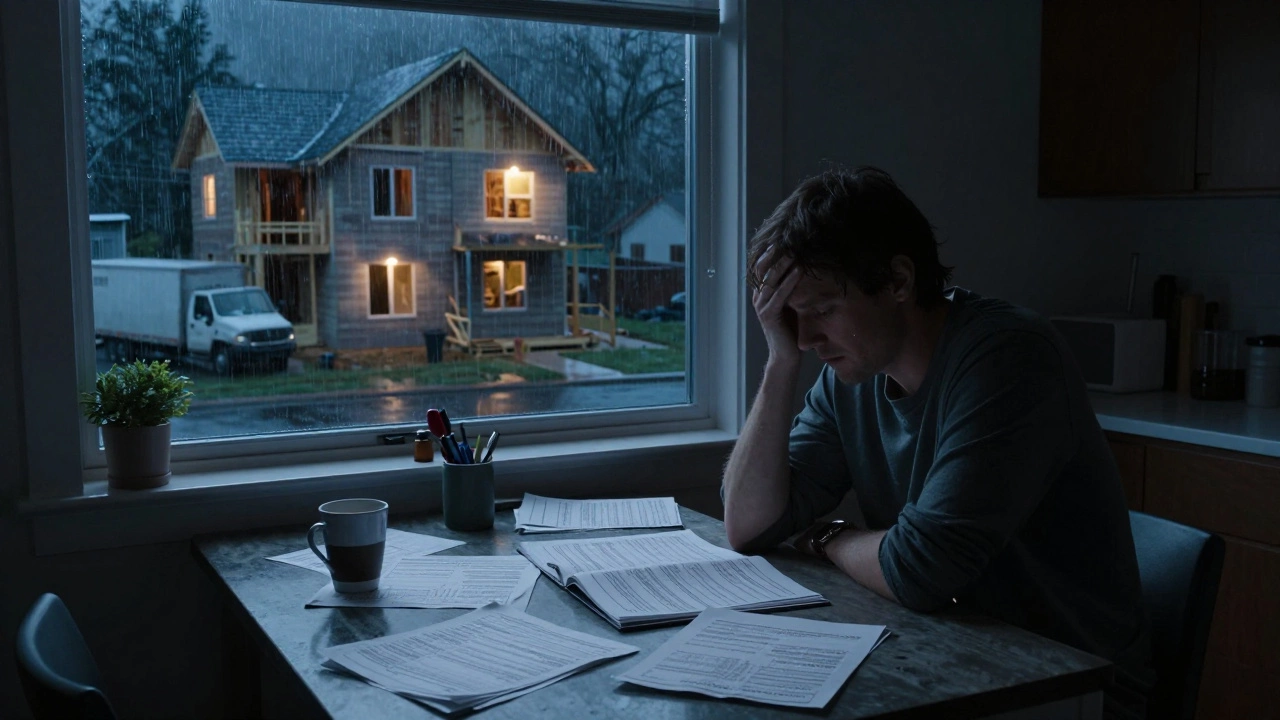

Building a house in 2025 isn’t just about picking cabinet pulls and tile colors. It’s a financial decision that can make or break your long-term stability. If you’re thinking about tearing down the rental agreement and starting from scratch, you need to know what’s really going to happen to your bank account. Most people assume building is cheaper than buying - but the truth? It’s rarely that simple.

What You Pay When You Build

In Halifax, building a 2,000-square-foot single-family home in 2025 costs between $450,000 and $650,000. That’s not including land. If you already own a lot, you’re ahead of most. But if you need to buy land - say, a half-acre lot in Dartmouth or Sackville - you’re looking at another $200,000 to $400,000. That’s before you even lay a single brick.

Here’s how that $450K-$650K breaks down:

- Materials: $180,000-$250,000 - lumber, insulation, windows, roofing, plumbing fixtures. Prices haven’t dropped since the 2022 spike.

- Labor: $150,000-$220,000 - trades are still in short supply. Electricians, plumbers, and framers charge $85-$125/hour.

- Permits and fees: $15,000-$25,000 - municipal charges, inspections, environmental reviews. Nova Scotia’s building code is strict, and delays add up.

- Design and engineering: $20,000-$40,000 - architects, structural engineers, energy modelers. You can’t skip this if you want a permit.

- Contingency: $45,000-$65,000 - you’re not getting out of this without surprises. Weather delays, material shortages, design changes - they all cost money.

Compare that to buying a similar-sized home in the same area. A 2,000-square-foot detached house built in 2010-2015 sells for $400,000-$550,000. You get move-in-ready plumbing, a roof that’s 10 years old, and no contractor drama.

Why Building Feels Cheaper (It’s Not)

People think building lets them avoid paying for someone else’s mistakes. But here’s the catch: you’re paying for your own mistakes too. And you’re paying for them upfront.

Let’s say you decide to upgrade from vinyl windows to triple-pane, argon-filled ones. That’s an extra $12,000. You think you’re saving on heating bills. Maybe. But you won’t see that return for 15-20 years - if you ever do. Meanwhile, your mortgage payment is already $3,000/month because your total project cost hit $700,000.

And then there’s the hidden cost: time. You’re not just spending money. You’re spending months - often over a year - living in limbo. If you’re renting while you build, you’re paying rent AND construction loans. That’s two housing payments at once. In Halifax, rent for a three-bedroom apartment is $2,800/month. Multiply that by 14 months? That’s $39,200 you didn’t budget for.

The Hidden Costs Nobody Talks About

Here’s what most builders don’t tell you until it’s too late:

- Soil testing and site prep: If your lot has clay or rock, you might need blasting or special foundations. That’s $20,000-$50,000 extra.

- Utility hookups: Running gas, water, and sewer from the street can cost $15,000 if you’re on the edge of a subdivision. Some rural lots need septic systems - $30,000-$50,000.

- Landscaping and driveways: You think sod and a gravel drive are optional? They’re not. A proper driveway costs $15,000. Landscaping? Another $10,000-$25,000.

- Insurance during construction: Builder’s risk insurance isn’t cheap. For a $600K project, expect $3,000-$5,000 over 12 months.

- Property taxes: Once the house is done, your taxes jump. A new build in Halifax can double your annual property tax bill from $3,000 to $6,000-$8,000.

And if you’re using a custom builder? You’re probably paying 15%-20% more than if you’d bought a speculative home from a developer. Builders charge for their brand, their team, their reputation. You’re paying for peace of mind - and that peace of mind costs extra.

When Building Makes Sense

It’s not all bad. There are real situations where building is the smarter move.

Case 1: You have land already. If your parents gave you a lot in a good neighborhood, you’ve already cleared the biggest financial hurdle. Now you’re just paying for the structure.

Case 2: You need a specific layout. Maybe you have aging parents moving in, or you’re building for accessibility. A custom home with zero-step entries, wider hallways, and a first-floor bedroom might cost more upfront - but it saves you $100,000 in future renovations.

Case 3: You’re building to sell. If you’re a seasoned investor with a solid exit plan, building a high-end home in a hot pocket like Lower Sackville or Clayton Park can yield a 25%-40% profit. But that’s not for beginners. You need to know the market, have cash reserves, and be ready to wait 18 months.

And here’s the quiet truth: building is only financially smart if you’re willing to live in the house for at least 7-10 years. That’s how long it takes to recoup the extra costs through equity growth and lower maintenance.

What Buying Gives You That Building Doesn’t

Buying a home means:

- You know exactly what you’re getting - no surprises from subcontractors.

- You can move in within 30-60 days.

- You’re not paying for someone else’s overhead.

- You can negotiate repairs or credits based on inspection results.

- You’re not stuck with a design you hate because you’re too far into the project to change it.

And here’s something most people forget: existing homes often come with mature trees, established gardens, and neighborhood infrastructure. A 1980s house in Clayton Park has oak trees that took 40 years to grow. You can’t buy that.

Real Numbers: Build vs Buy in Halifax (2025)

| Item | Build a New Home | Buy a Similar Existing Home |

|---|---|---|

| Home size | 2,000 sq ft | 2,000 sq ft |

| Construction cost | $450,000-$650,000 | N/A |

| Land cost (if needed) | $200,000-$400,000 | Already included |

| Design & permits | $35,000-$65,000 | $0 |

| Rent during build | $30,000-$40,000 | $0 |

| Landscaping & driveway | $25,000-$40,000 | $0-$15,000 (already there) |

| Property taxes (annual) | $6,000-$8,000 | $4,000-$6,000 |

| Total upfront cost | $750,000-$1.2M | $400,000-$550,000 |

| Move-in timeline | 12-18 months | 30-60 days |

Who Should Avoid Building Altogether?

If any of these sound like you, skip the build:

- You’re on a tight budget with no cash buffer.

- You’re not ready to be a project manager for 18 months.

- You’ve never dealt with contractors or permits before.

- You’re counting on the house to appreciate fast so you can flip it.

- You’re stressed easily - and construction delays are inevitable.

Building a house isn’t a lifestyle upgrade. It’s a full-time job with no vacation. And if you’re not prepared for that, you’ll end up with a beautiful home - and a lot of debt.

Final Thought: It’s Not About Saving Money - It’s About Control

Most people who build don’t do it to save money. They do it because they want control. They want the exact layout, the right windows, the perfect kitchen island. And that’s valid. But control comes at a price - and that price isn’t just dollars. It’s sleep, time, and peace of mind.

If you want control and you have the resources, go for it. But if you’re trying to save money, buy an existing home. Renovate it later. You’ll get 90% of the satisfaction for half the cost and a quarter of the stress.

Is it cheaper to build a house or buy one in Halifax in 2025?

In 2025, buying an existing home in Halifax is almost always cheaper than building. A new build costs between $750,000 and $1.2 million when you include land, design, permits, and living expenses during construction. A similar existing home sells for $400,000-$550,000. The gap comes from labor shortages, material costs, and hidden fees like utility hookups and landscaping.

How long does it take to build a house in Nova Scotia?

In Nova Scotia, building a custom home takes 12 to 18 months on average. Weather delays, permit backlogs, and trade shortages can push it to 20 months. Even with a reliable builder, you can’t rush framing or curing concrete. If you’re counting on moving in quickly, building isn’t the right choice.

Do new builds appreciate faster than older homes?

Not necessarily. In Halifax, new builds don’t appreciate faster than well-maintained older homes in established neighborhoods. Buyers often pay a premium for mature trees, proven school districts, and walkable streets - things you can’t build. A 1970s home in Fairview might sell for more than a brand-new one in a new subdivision.

Can I save money by acting as my own general contractor?

Almost never. Most people who try to manage their own build end up spending more due to mistakes, delays, and buying materials at retail instead of contractor rates. You also need a license to pull permits in Nova Scotia if you’re not the homeowner. Even then, you’re responsible for every subcontractor’s work - and every mistake costs you.

What’s the biggest financial mistake people make when building?

The biggest mistake is forgetting to budget for living expenses during construction. Most people assume they’ll live in their new home while it’s being built. But you’re almost always renting elsewhere. Add $2,800/month for 14 months? That’s $39,200 - and it’s rarely included in initial estimates.